Backdoor roth ira calculator

Ad Explore Your Choices For Your IRA. Schwab Is Here To Help You Understand Your Options.

Roth Ira Married Filing Jointly Your Financial Pharmacist

140000 for single filers.

. Discover Bank Member FDIC. A backdoor Roth IRA is a Roth IRA that is created when those who cannot open Roth IRAs due to income limits convert their traditional IRAs into a Roth IRA. Get Up To 600 When Funding A New IRA.

Backdoor Roth Ira Conversion Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the. Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance. Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals.

Total taxes with current account. The backdoor to a Roth IRA opens when an individual makes contributions to a traditional IRA or rolls over funds from a 401 k plan then converts them to a Roth IRA. Roth IRA Conversion Calculator.

Read Tip 91 to learn more about Fisher Investments advice regarding IRA conversions. Roth Conversion Calculator Methodology General Context. Get Up To 600 When Funding A New IRA.

Rolling Over a Retirement Plan or Transferring an Existing IRA. Find a Dedicated Financial Advisor Now. Ad Do Your Investments Align with Your Goals.

Our free Roth IRA calculator can calculate your maximum annual contribution and estimate how much youll have in your Roth IRA at retirement. An Edward Jones Financial Advisor Can Partner Through Lifes Moments. The big benefit of a Roth IRA is that your withdrawals are tax-free in retirement.

208000 for married couples filing jointly. Ad Learn The Benefits And Limitations. On the positive side an increasing number of employers have added Roth options.

There are a few tax. In 2021 those limits are. Ad Do Your Investments Align with Your Goals.

Ad Open a Roth or Traditional IRA CD Today. A backdoor Roth IRA allows individuals with income above the maximum limit to contribute to Roth IRAs and enjoy the benefits of the type. Well walk you through the important considerations before initiating a Roth IRA conversion.

Backdoor Roth Ira Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the. Explore Choices For Your IRA Now. Total taxes with converted Roth.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Discover Makes it Simple. Roth IRA Conversion Calculator.

A backdoor Roth is an excellent option for those who want to take advantage of a Roth IRA but their income makes them ineligible for direct contributions. A method that taxpayers can use to place retirement savings in a Roth IRA even if their income is higher than the maximum the IRS allows for regular Roth. Does converting to a Roth IRA make sense for you.

Backdoor Roth IRA. Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Projected tax savings with a roth conversion.

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Home financial roth ira. You can take advantage of a.

Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. The thing is in the first year that you do the Backdoor Roth your tax savings is probably going to be somewhere in the range of 10 to 40. Titans Roth IRA calculator gives anyone the ability to project potential returns from a Roth IRA retirement account based on your current age how much you plan to contribute each year the.

A backdoor Roth IRA isnt a special type of individual retirement account. Backdoor Roth Ira Calculator Overview. Build Your Future With a Firm that has 85 Years of Investment Experience.

Whats more Roth IRAs are not subject to required minimum distributions so you can let the. A mega backdoor Roth lets people save as much as 38500 in a Roth IRA or Roth 401k in 2021. Current AgeYour age today.

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. But not all 401k plans allow them. Were comparing investing 6000.

An Edward Jones Financial Advisor Can Partner Through Lifes Moments. Ad Visit Fidelity for Retirement Planning Education and Tools. And now you contribute 6000 to a new traditional IRA with after-tax dollars then immediately convert that 6000 to a Roth via the backdoor Roth IRA strategy.

In 2019 I made a conversion to Roth in the amount of 7947. Rather a backdoor Roth IRA is a strategy that helps you save retirement funds in a Roth IRA even. The value of all my traditional IRAs because of the 401 k pre-tax funds rollover is 160697 as of 12312019.

Find a Dedicated Financial Advisor Now.

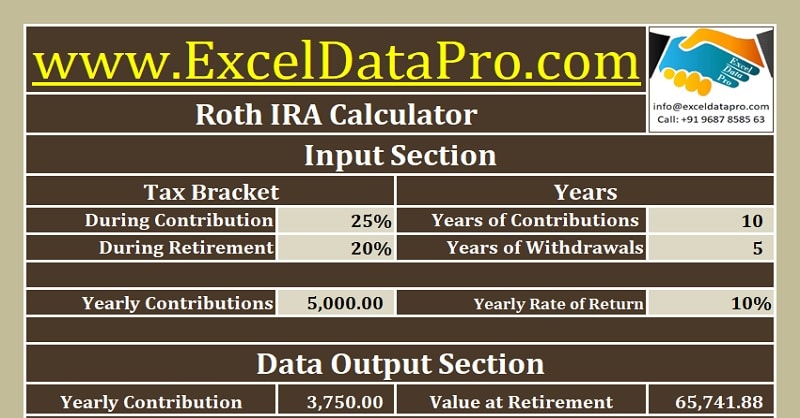

Download Roth Ira Calculator Excel Template Exceldatapro

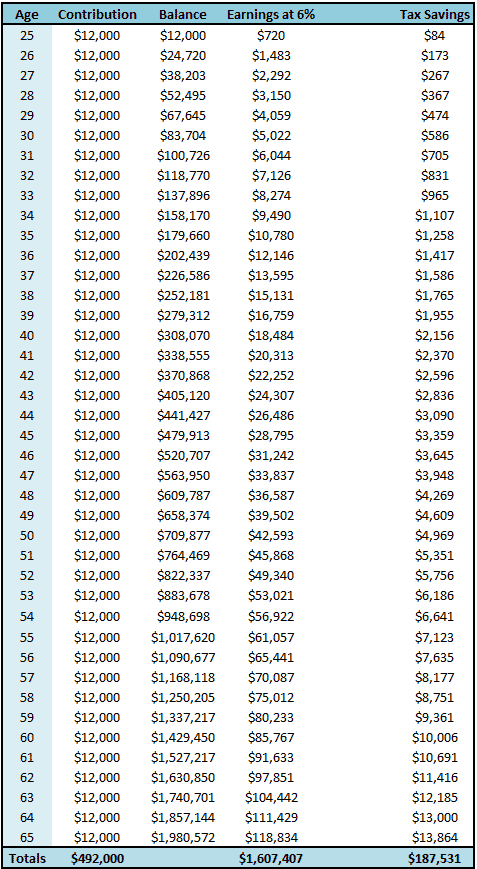

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

The Benefits Of A Backdoor Roth Ira Financial Samurai

Factors To Consider When Contemplating A Backdoor Roth Ira

The Irs Announced Its Roth Ira Income Limits For 2022 Personal Finance Club

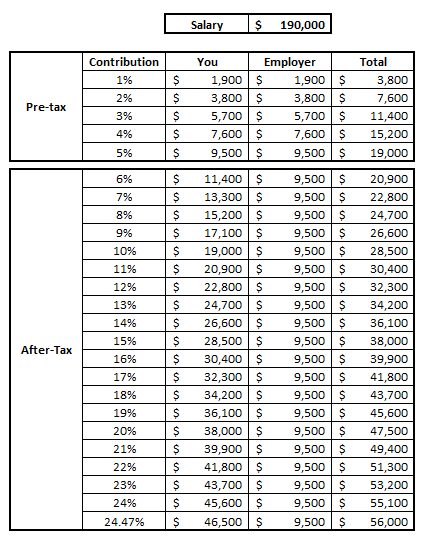

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

The Requirements And Steps To Using A Mega Backdoor Roth Ira

How Does A Backdoor Roth Ira Work Personal Finance Club

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Is It Worth Doing A Backdoor Roth Ira Pros And Cons

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth Ira Calculator Roth Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal